Why Invest in the United Kingdom?

We are one of the worlds strongest Economies !

- Time Line

- 2014 – UK RANKED 5th - $2.9 trillion

- 2013 – UK RANKED 6TH - $ 2.7 trillion

- 2012 – UK Ranked 6th - $ 2.6 trillion

- 2011 – UK Ranked 7th - $2.6 trillion

- 2010 – UK ranked 6th - $ 2.4 trillion

“Britain is living through the best time ever” Britain's economy is going through a renaissance – we are living through one of the best times ever.

At the beginning August 2015, both the Office for National Statistics (ONS) and the Bureau of Economic Analysis (BEA), the respective UK and US statistical agencies, made GDP revisions. The US has been revised down and the UK has been revised up. Source: Business Insider UK

New year, new growth: 2016 economic outlook The UK economy appears to be on the cusp of a period of sustained good health. SOURCE: Telegraph

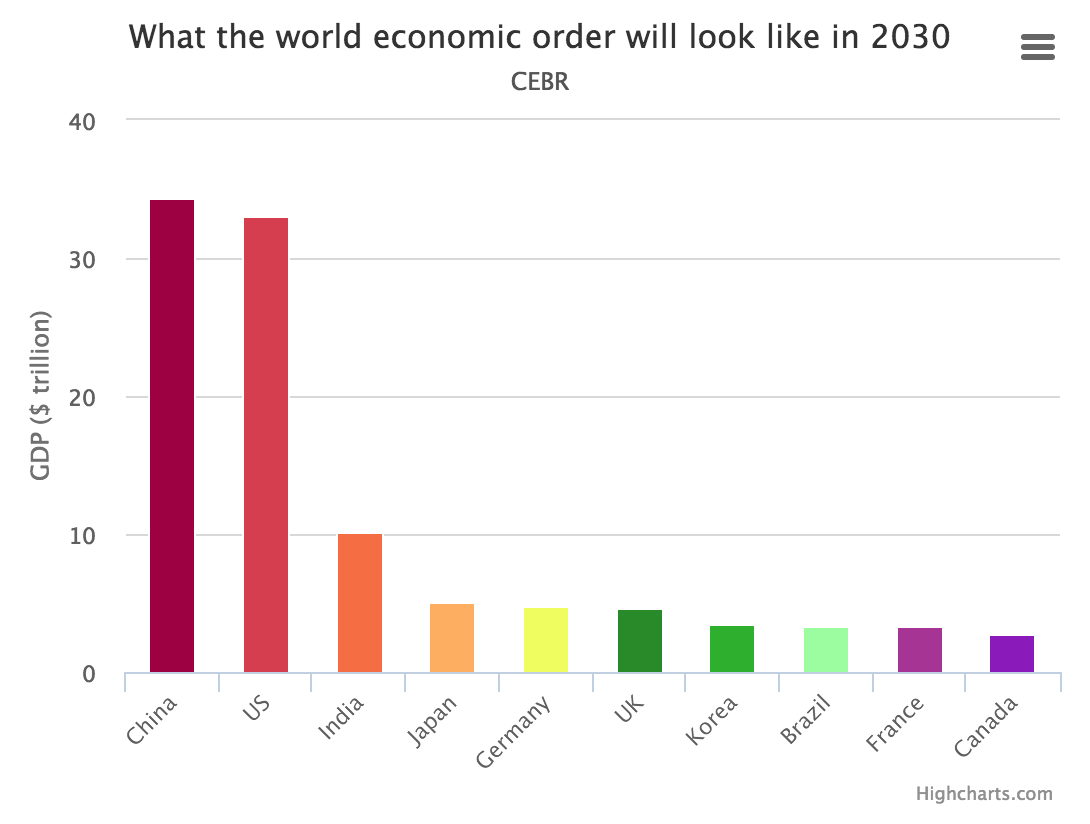

Britain will reach the "giddy" heights of the fourth largest economy in the world, leapfrogging Germany and Japan over the next two decades, new analysis shows.

The UK is set to become the best performing economy in the western world over the next 15 years, boosted by its leading position in global software and IT sectors, according to a report by the Centre for Economics Business and Research.

By contrast, the stagnant Italian and French economies are set to be replaced in the world's new economic order by growth giants of the emerging world - India and Brazil.

Britain is currently the world's fifth largest economy based on total Gross Domestic Product (GDP), which currently stands at $3.04 trillion. The UK overtook France in GDP terms in 2014.

Bumper growth will put Britain on course to become the world's fourth largest economic powerhouse ahead of an ageing Japan and Germany in the 2030s, according to the CEBR's latest world economic league table. The total cash value of the UK economy will grow to around $4.7 trillion by 2031, but is expected to be quickly overtaken by Brazil in fourth spot by the 2040s.

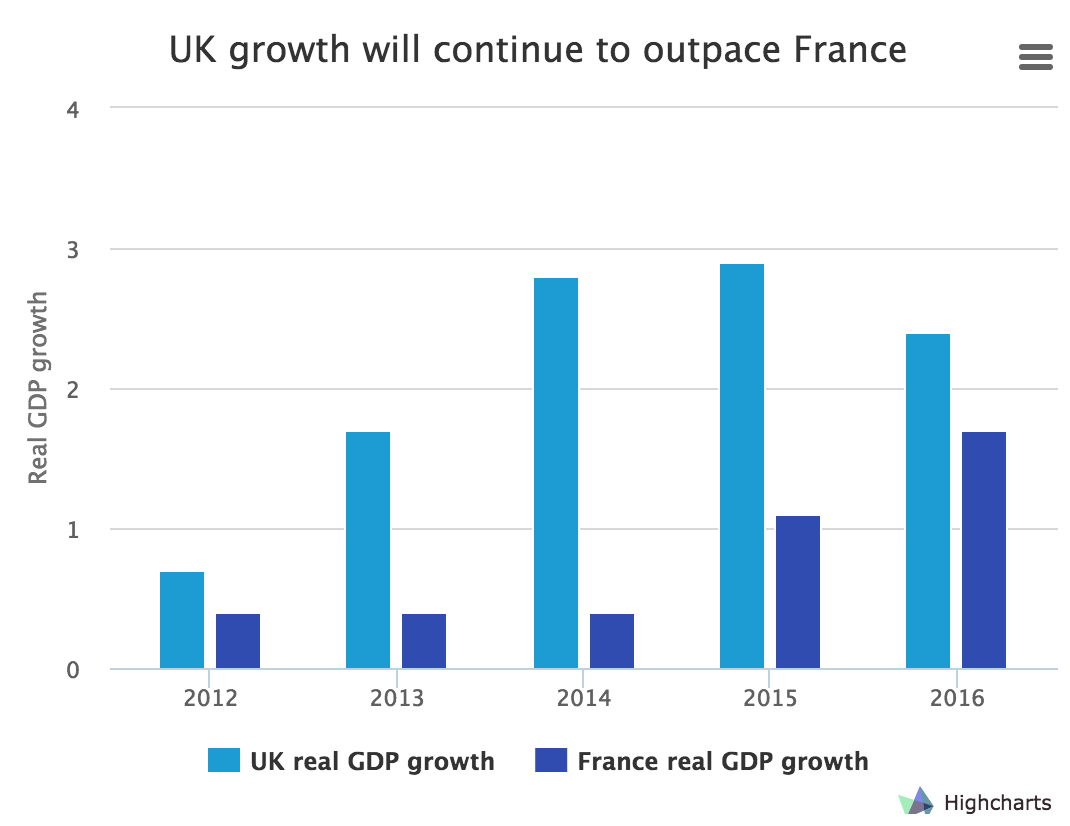

UK economic growth is set to hit 2.9pc this year, the second fastest in the advanced world after the United States. It means the economy is now 6.1pc larger than its pre-financial crisis peak. The Treasury said the CEBR's analysis was evidence that the Government's long-term economic plan was working, with the deficit reduced by almost two thirds as a share of GDP since its peak in 2009-10 and an average of 1,000 extra people in work each day.

Britain's fortunes are in sharp contrast with France and Italy, which face "exclusion" from the grouping of the world's advanced economies, said the CEBR.

Europe's third and fourth largest economies will be replaced by India and Brazil in the G8 over the next 15 years, as they fight years of low growth and ageing populations, warned the report.

As Brazil and India meet the political criteria for membership of the exclusive G8 club of developed democracies, their ascension could see France and Italy kicked out of the group, or the club expanded to a G10 as more economies join.

The CEBR said France's "dire" economic prospects will see it fall from the world's 5th to 9th largest economy by 2030.

France's socialist government has been on a drive to carry out radical spending cuts and roll-out new economic reforms in a bid to revive economic growth.

• France warned to curb 'critically high' public spending by IMFBut the CEBR said "the pace of French economic reform is far too slow even for the economy to tread water in the world economy." France will grow by 1.1pc this year, and average just 1.25pc GDP growth over the next five years, according to the International Monetary Fund.

Italy - currently 8th in the global league table - has suffered even worse fortunes. Since joining the euro in 2000, GDP growth has remained flat, making it the slowest growing economy of any major developed nation. Italy also has the second highest debt mountain in the eurozone after Greece at over 132pc of GDP. Its global position is set to slip by five places to 13th by 2030.

Europe's largest economy, Germany, however will maintain its position in the world's top five as its declining population receives a welcome boost of a 1.5 million refugees and migrants, according to the analysis. "The additional migrants will boost profits, restrain wage growth and alleviate skill shortages," said the CEBR.

China's recent growth slowdown will delay its rise to become the largest economy in the world. China is now on course to overtake the US in nominal GDP terms by 2029, against the CEBR's earlier forecast of 2025.

The CEBR, however, warned Britain's economic performance could be derailed by a number of major political risks - such as the breakup of the United Kingdom and an exit from the European Union. They noted that a "Brexit" would "prove at best disruptive and at worst lead to a more insular and less diverse culture which in turn would generate slower growth". Britain's uneven economic performance - where growth has been concentrated in booming London - and weak exports, are also risks to prosperity over the next 15 years, said the report.

Visitor economy facts

Source: Tourism: jobs and growth. Deloitte November 2013

Source: Tourism: jobs and growth. Deloitte November 2013

Since 2010 tourism has been the fastest growing sector in the UK in employment terms. Britain is forecast to have a tourism industry worth over £257 billion by 2025.

The Deloitte Tourism: jobs and growth report found that the marginal revenue required to create a job in UK tourism is estimated to be around £54,000. For every 1% increase in total expenditure in UK tourism, it might be expected that full time equivalent employment will increase by 0.89%. The sector is predicted to grow at an annual rate of 3.8% through to 2025 - significantly faster than the overall UK economy (with a predicted annual rate of 3% per annum) and much faster than sectors such as manufacturing, construction and retail.

Britain will have a tourism industry worth over £257 billion by 2025 – just under 10% of UK GDP and supporting almost 3.8 million jobs, which is around 11% of the total UK number.

Inbound tourism will continue to be the fastest growing tourism sector – with spend by international visitors forecast to grow by over 6% a year in comparison with domestic spending by UK residents at just over 3%. The value of inbound tourism is forecast to grow from over £21bn in 2013 to £57bn by 2025, with the UK seeing an international tourism balance of payments surplus in 2023, almost forty years since the UK last reported a surplus.

Source : Visit Britain

Real Estate Investment

Real Estate Investment Alternative Investment

Alternative Investment Investment Opportunities

Investment Opportunities